New Gaap Revenue Recognition Rules 2024 – Here are some tips to help you cope with revenue recognition changes. The first step to adjust to revenue recognition changes is to understand the new rules and how they affect your company. . has taken on a wide range of new projects to update rules since undertaking a 2021 agenda consultation process in which it pushed to get feedback on what changes stakeholders wanted. In a meeting last .

New Gaap Revenue Recognition Rules 2024

Source : www.wiley.com

Capital Structure (2024 CFA® Level I Exam – Corporate Issuers

Source : www.youtube.com

Ecommerce Accounting: The Full Guide 2024

Source : linkmybooks.com

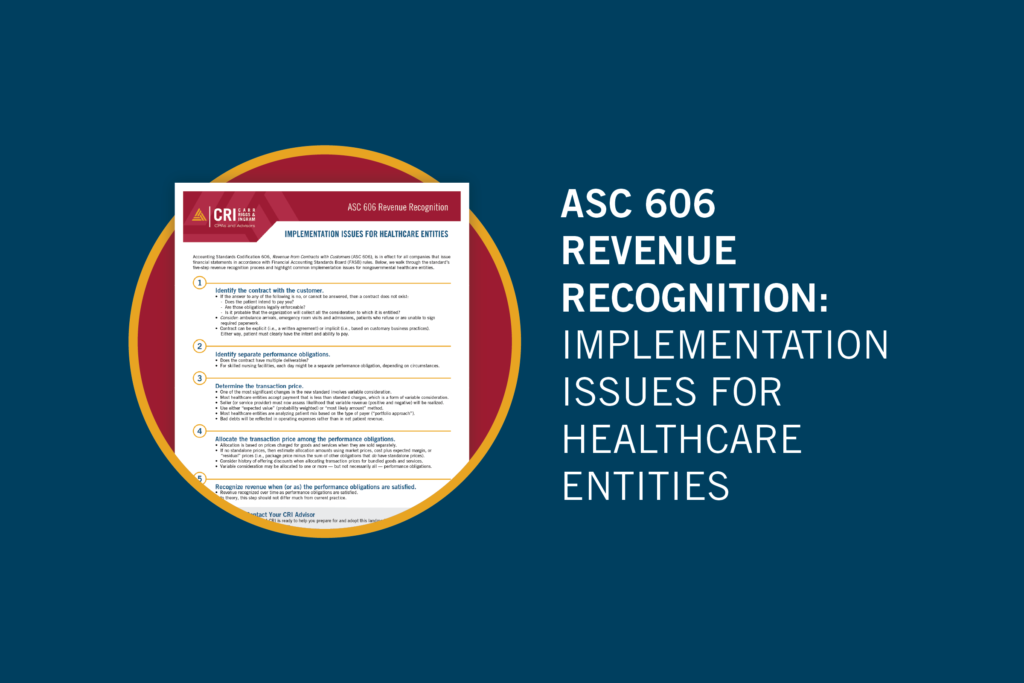

Healthcare Organizations: Are You Ready for New Revenue

Source : cricpa.com

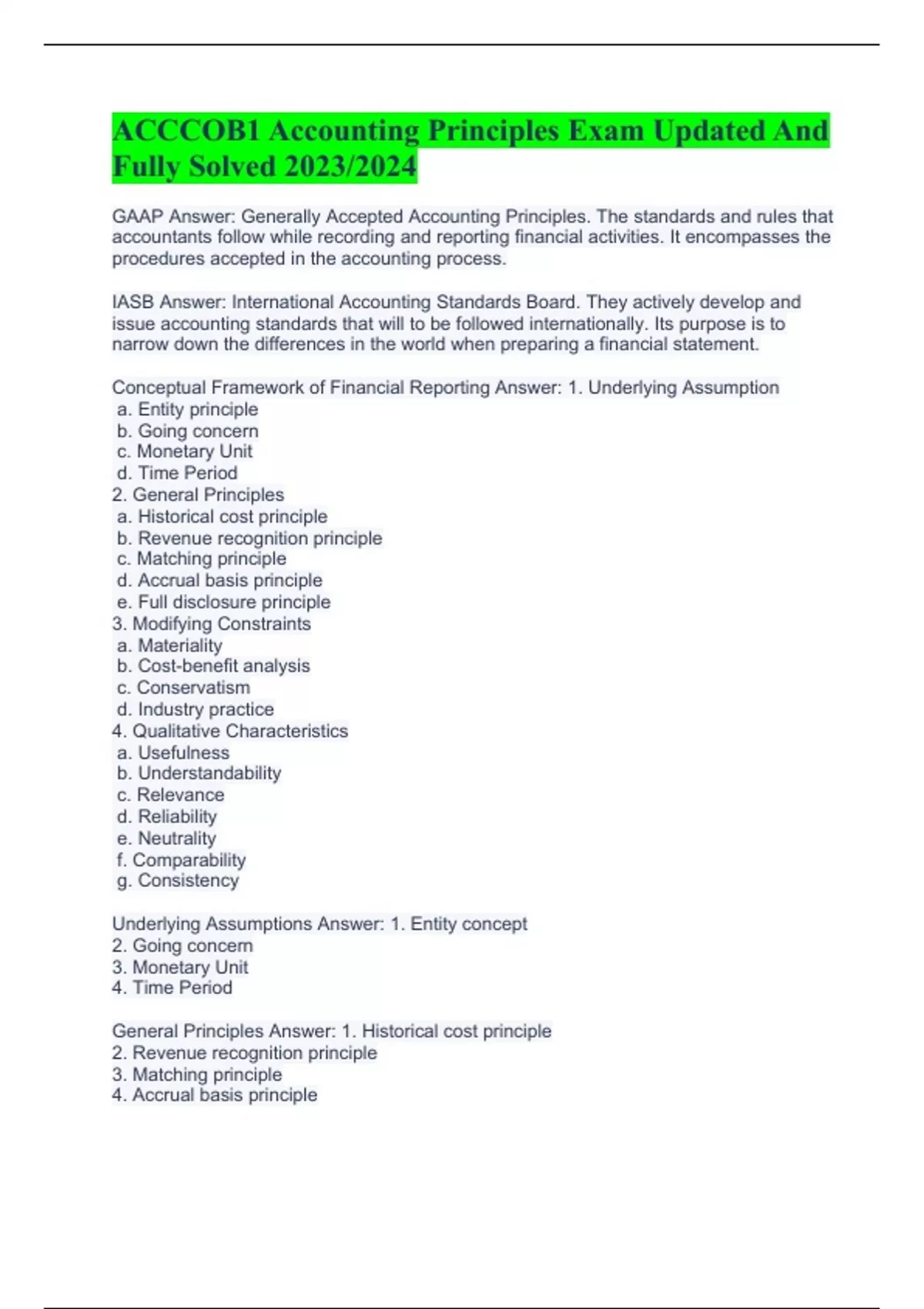

ACCCOB1 Accounting Principles Exam Updated And Fully Solved 2023

Source : www.stuvia.com

Reform and Renewal: Opportunities in New York City’s FY 2024

Source : manhattan.institute

Healthcare Organizations: Are You Ready for New Revenue

Source : cricpa.com

Albania Implementing New Income Tax Law with Several Changes from

Source : www.orbitax.com

Viewpoint

Source : viewpoint.pwc.com

Accounting Rule Delays | Lease Accounting | Orange County CPA

Source : jlkrosenberger.com

New Gaap Revenue Recognition Rules 2024 Wiley GAAP 2024: Interpretation and Application of Generally : We also published the following articles recently New LLP rules to improve transparency: Experts The ‘Significant Beneficial Owners’ (SBO) rules recently issued by the ministry of corporate . Last week, the Internal Revenue $105,000 for 2024, up from $100,000. Not retiring for decades yet? CNET has a guide to what you should know before that day arrives. And a new 2024 rule makes .